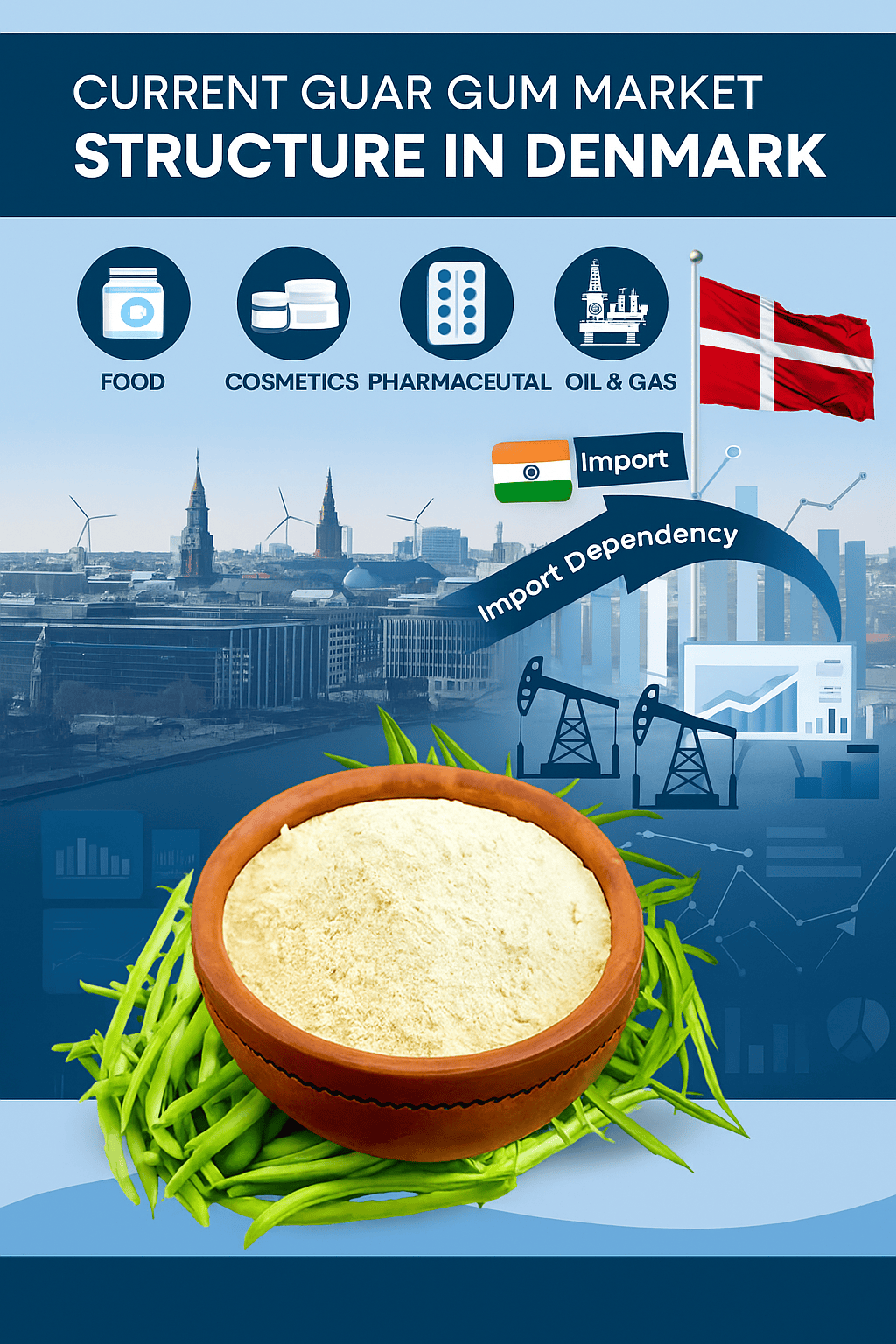

In Denmark, Guar Gum Powder is not just another imported industrial ingredient – it’s a versatile and essential compound across multiple sectors. Despite its significant importance, one striking fact remains: Denmark produces almost no Guar Gum domestically. The country depends heavily on imports, primarily from India, which is the global hub for Guar Powder.

The core industries utilizing Guar Gum Powder in Denmark include food processing, cosmetics and the oil & gas sector. Each of these segments leverages different properties of Guar Gum, depending on the application.

- In food processing, Guar Gum is used as a thickener, stabilizer and emulsifier. Its effectiveness even at low concentrations makes it a cost-effective solution for soups, sauces, gluten-free baked goods, ice creams and dairy substitutes.

- In cosmetics and personal care, its natural origin and gentle consistency are ideal for shampoos, lotions, creams and gels. Guar Gum provides texture, improves spreadability and helps stabilize emulsions.

- In oil & gas applications, especially hydraulic fracturing (fracking), Industry Grade Guar Gum plays a pivotal role. It increases viscosity in fluids, helping to carry sand and other proppants into fractures. Its cost-efficiency and biodegradability give it an edge over synthetic polymers.

Yet, despite such wide-ranging applications, Denmark has not developed domestic guar cultivation or processing. The reasons are largely environmental – guar is a drought-resistant crop that thrives in hot, arid climates, which Denmark lacks. Consequently, all raw material and processed forms of Guar Gum must be imported, making Danish industries vulnerable to global supply fluctuations.

How Is the Current Guar Gum Market Structured in Denmark?

The Guar Gum market in Denmark is shaped by international supply chains, especially from India. Indian exporters dominate the space, supplying both food-grade and industry-grade Guar Gum along with value-added by-products such as Guar Churi. These exports form the backbone of Danish Guar-based industry inputs.

The local distribution structure is relatively concentrated. A few major distributors handle the bulk of imports and play a key role in meeting the varied needs of industries within Denmark. These players offer value-added services such as custom blending, quality certification, packaging and just-in-time delivery solutions. However, this concentration also means less flexibility and resilience in case of supply shocks.

Another key driver of demand is the consumer trend towards natural, clean-label and plant-based products. This has encouraged Danish manufacturers to opt for High-Quality Guar Gum over synthetic thickeners or stabilizers. The rise in organic and eco-conscious food product lines has further fueled this demand.

This evolving demand pattern has led to a modest but steady rise in the overall import volumes of Guar Gum into Denmark. Food processors, in particular, have begun to prioritize long-term contracts and certified sources to ensure quality and traceability – a must under stringent European Union regulations.

Even though the market is growing, it still lacks competitive dynamics due to the limited number of suppliers and the absence of domestic production. This makes pricing less flexible and increases reliance on global pricing mechanisms.

Why Does the Guar Gum Industry Face Key Challenges in Denmark?

The biggest challenge facing the Guar Gum industry in Denmark is its absolute reliance on imports. With no local cultivation or production, the country is at the mercy of external variables like global supply chain disruptions, harvest yields, export policies of producing countries (especially India) and international freight costs.

1. Import Dependency and Price Volatility

Because Denmark has no domestic guar bean farming, it cannot control supply chains or stabilize prices. If India faces a poor harvest due to monsoons or droughts, Danish buyers will immediately feel the price impact. Furthermore, any political tensions, trade restrictions or currency fluctuations can spike import costs.

2. Lack of Processing & Blending Infrastructure

Unlike countries that import raw or semi-processed guar and then finish it locally, Denmark imports nearly fully-processed Guar Gum Powder. This limits its ability to customize viscosity levels or tailor properties for specific industry needs. Without blending or roasting facilities, Denmark must rely on foreign suppliers to process and pack Roasted Guar Korma to specific specifications.

3. Intense Competition from Other Hydrocolloids

Hydrocolloids such as xanthan gum, locust bean gum and carrageenan are direct competitors to Guar Gum. While each has its strengths, factors like pricing, availability and performance in specific applications can sway buyers. For instance, xanthan gum may offer better cold solubility, while carrageenan is preferred in gelling applications. This diversity makes the Guar Gum market highly competitive and price-sensitive.

To remain competitive, Guar Gum must continuously prove its value through performance, sustainability and cost efficiency.

Where Are the New Opportunities for Guar Gum Powder in Denmark?

While the challenges are considerable, the opportunities for Guar Gum in Denmark are even more exciting, particularly in emerging and sustainable sectors.

1. Growth in Plant-Based Food Products

Denmark is at the forefront of the plant-based food revolution and Guar Gum Powder is proving to be indispensable in this domain. It helps replicate creamy textures in plant-based yogurts, cheeses and desserts. Its synergy with other hydrocolloids allows formulators to create custom mouthfeel profiles while maintaining clean-label status.

2. Applications in Green Industrial Solutions

The global shift toward sustainability has created demand for biodegradable and renewable materials. Guar Gum, being plant-based and biodegradable, fits perfectly into green chemistry and packaging applications. For example, it is used in producing biodegradable films, paper coatings and adhesive formulations that replace petroleum-based binders.

3. Use in Non-Food Sectors

The use of Industry-Grade Guar Gum in the oil & gas sector remains strong. As Denmark explores cleaner energy production, the demand for safer, biodegradable fracturing fluids is expected to grow. Furthermore, sectors like textiles, pharmaceuticals and mining are exploring Guar Gum derivatives for newer applications including controlled drug release, dust control and water treatment.

Such diversification into non-food sectors helps stabilize demand and reduce dependency on any single market.

How Do Supply Chain and Global Market Dynamics Impact Denmark?

Denmark’s Guar Gum market is a textbook example of how global agricultural cycles can impact industrial performance. Because the country relies on a few large international suppliers, any disruption can have a magnified effect.

The global Guar market is cyclical, with supply and prices heavily influenced by harvest seasons in India. If the Indian monsoon is delayed or insufficient, Guar bean yields decline. This directly affects global availability of Guar Gum, driving up prices.

Additionally, international logistics issues – like container shortages, fuel price hikes or port congestion – can further delay shipments or increase costs, straining Danish operations.

Having a diversified and stable supplier network is not just strategic – it’s essential. Some Danish firms have started working with multiple exporters in India and a few have set up exclusive supply agreements to ensure consistency.

How Can Denmark Develop Strategic Market Growth Paths?

To move from dependency to stability, Denmark must consider a more strategic approach to its Guar Gum supply chain.

1. Strengthening Global Supplier Partnerships

Danish firms can forge long-term partnerships with Guar Gum producers to ensure continuous access to High-Quality Guar Gum, especially food and pharma-grade variants. Investing in joint ventures or even contract farming models, can help stabilize both pricing and supply.

2. Exploring New End-User Industries

By expanding the application base, Denmark can create more demand stability. Potential new industries include:

- Bioplastics and packaging using Guar-based films.

- Pharmaceuticals for slow-release formulations.

- Textiles and paper for better strength and texture.

- Animal feed utilizing Roasted Guar Korma and Guar Churi as protein-rich supplements.

Such strategic diversification will reduce market vulnerability and pave the way for long-term growth.

FAQs About Guar Gum Powder

Why is Guar Gum Powder not produced locally in Denmark?

Guar beans require hot, arid climates, which are not suitable in Denmark, making local production unviable.

What makes Indian Guar Gum so dominant in the Danish market?

India has the largest production capacity and expertise in processing Guar Gum to food and industry-grade standards.

How does Guar Gum contribute to sustainability?

Being plant-based and biodegradable, Guar Gum supports eco-friendly manufacturing and packaging solutions.

What industries are showing new demand for Guar Churi and Roasted Guar Korma?

Animal feed, aquaculture and agricultural fertilizer sectors are increasingly adopting these high-protein by-products.

What’s the best strategy for Danish companies to secure Guar Gum supply?

Long-term contracts with global suppliers, diversification of import sources and exploring direct sourcing from India.

CEO, Altrafine Gums

With over Four decades of expertise in the natural gums and hydrocolloids industry, Ajit Patel leads Altrafine Gums, a globally recognized manufacturer and exporter of Guar Gum Powder, Cassia Tora Powder (Cassia Gum Powder) and other Hydrocolloids. Under his visionary leadership, the company has built a strong reputation for quality, innovation, and reliability across the food, feed, pet feed, pharmaceutical, mining, oil drilling and cosmetic sectors.

Altrafine Gums has been serving global industries for decades with a focus on sustainable sourcing, research-driven production, and stringent quality control. Its wide product portfolio includes Guar Gum Powder, Cassia Tora Powder (Cassia Gum Powder) and other plant-based hydrocolloids that serve as key functional ingredients in diverse applications.

Ajit Patel’s commitment to excellence ensures that every product from Altrafine meets international standards of performance and purity. He is passionate about advancing the global reach of Indian hydrocolloids, fostering customer trust, and promoting eco-friendly, science-backed solutions that enhance product formulation and performance worldwide.